|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

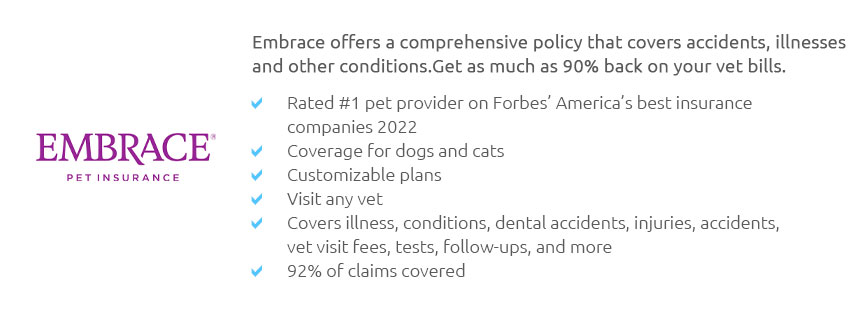

The Best Pet Insurance Companies: A Comprehensive Guide for Pet OwnersChoosing the right pet insurance can be as perplexing as picking the perfect treat for your furry friend. With myriad options available, understanding the nuances of each company is crucial. Here, we delve into some of the most reputable pet insurance providers, offering you a comprehensive guide to make an informed decision. Understanding Pet Insurance is pivotal before you dive into the specifics. In essence, pet insurance is designed to cover veterinary expenses when your beloved pet falls ill or is injured. Some policies even include coverage for routine care. The key is to balance coverage against cost, ensuring your pet's health needs are met without breaking the bank. Healthy Paws often emerges as a favorite among pet owners. Its straightforward, all-inclusive plan ensures that there's no confusion about what's covered. With no caps on payouts, Healthy Paws distinguishes itself by offering a simple claims process, making it an excellent choice for those who value efficiency. However, it's worth noting that they do not cover routine check-ups or pre-existing conditions. Another contender in the realm of pet insurance is Embrace. Known for its customizable plans, Embrace allows pet owners to tailor their insurance to meet specific needs, including coverage for breed-specific conditions. One standout feature is its 'diminishing deductible,' which rewards policyholders for every year they don’t claim. This feature can be particularly appealing if your pet remains healthy over long periods. For those seeking comprehensive coverage, Nationwide is worth considering. As one of the few companies offering exotic pet insurance, Nationwide provides an array of options for both common and uncommon pets. Their 'Whole Pet with Wellness' plan is particularly noteworthy, covering not just accidents and illnesses but also wellness exams, vaccinations, and flea prevention. However, some may find Nationwide's pricing on the higher side. Trupanion is another stellar option, especially for pet owners who prioritize straightforwardness and extensive coverage. Trupanion is unique in that it offers direct vet payments, which means you won't need to pay out of pocket and wait for reimbursement. This can be a significant advantage during emergencies. While Trupanion's plans are comprehensive, they do not cover routine care, which is something to consider. Petplan deserves a mention for its extensive coverage options and flexibility. Offering coverage for hereditary and chronic conditions, Petplan allows policyholders to choose their deductible, reimbursement level, and annual limit. This customization ensures that you can find a plan that fits your budget and coverage needs. Petplan also covers advertising and reward costs if your pet is lost, a unique feature that may appeal to many. As you navigate the landscape of pet insurance, it’s essential to assess your pet’s specific needs, considering factors such as age, breed, and existing health conditions. Remember, the best pet insurance is one that provides peace of mind and meets the unique needs of your pet and your budget. In conclusion, while there are numerous pet insurance providers to choose from, each with its strengths and weaknesses, the key is to research thoroughly and consider your pet’s current and future health needs. Whether it’s the comprehensive coverage of Nationwide, the simplicity of Healthy Paws, or the customizable options from Embrace, there’s an insurance plan out there that’s just right for you and your pet. https://www.petinsurancereview.com/

We are an affiliate site that allows users to browse, compare and read reviews from the top pet insurance providers. https://www.petsbest.com/

Pets Best offers pet insurance plans for dogs and cats covering up to 90% of your unexpected veterinary costs with no annual or lifetime payout limits and ... https://www.cnbc.com/select/is-pet-insurance-worth-it/

The best pet insurance companies for your four-legged family members - Pets Best pet insurance review: No age limit and direct-pay option make this a top pick.

|